Trade credit is a common practice in the steel industry, where suppliers offer credit terms to their customers. These credit terms can be in the form of delayed payment or a credit line that allows the customer to purchase steel products on credit.

In the steel industry, trade credits are used to maintain a good relationship between suppliers and customers. Steel suppliers often provide trade credits to their customers to ensure they can purchase steel products without disrupting their cash flow. This helps maintain a steady supply of steel products and ensures that customers are not hindered by cash flow issues.

The terms of trade credit in the steel industry can vary depending on the supplier, the customer, and the market conditions. Suppliers may offer different credit terms to different customers based on their creditworthiness and payment history. In some cases, suppliers may also require collateral or a personal guarantee to secure the credit line.

Overall, trade credit is an important aspect of the steel industry, as it allows suppliers to maintain a stable customer base and customers to purchase steel products without disrupting their cash flow.

Steel Industry Without Trade Credits

The steel industry heavily relies on trade credit to maintain a stable and profitable business. Without trade credit, the industry would likely face several challenges that could hinder its growth and profitability.

● Without trade credit, customers would need to pay for steel products immediately upon delivery. This can be challenging for customers who have limited cash flow or face unexpected expenses, which could lead to delayed payments or missed payments. As a result, suppliers may experience cash flow issues and may struggle to maintain a consistent revenue stream.

● Without trade credit, suppliers may find it challenging to build strong relationships with their customers. Relationships are critical in the steel industry, as they often determine whether a customer will continue to purchase from a supplier in the long term. Trade credit allows suppliers to establish a level of trust and goodwill with their customers, which can help strengthen relationships and lead to repeat business.

● Without trade credit, businesses can face challenges in managing credit risk effectively. Without access to credit information and credit scoring tools, suppliers may struggle to assess the creditworthiness of their customers accurately. This could result in bad debt and financial losses for suppliers.

● Without trade credit, steel industries can find it challenging to optimize their inventory levels. Trade credit allows suppliers to encourage customers to purchase larger quantities of steel products, which can help suppliers manage their inventory levels effectively and reduce the cost of holding excess inventory.

Benefits of Trade Credits in Steel Industry

Trade credit is a common practice in the steel industry, where suppliers offer credit terms to their customers. The benefits of trade credit in the steel industry are numerous and can be broken down into several key areas :

● Cash Flow Management: Trade credit allows customers to purchase steel products without having to pay for them immediately. This can help customers manage their cash flow better, as they can use their funds for other purposes and pay for the steel products at a later date. By extending trade credit, suppliers can also maintain a steady cash flow and ensure a consistent revenue stream.

● Relationship Building: Trade credit is an effective way for suppliers to build relationships with their customers. By offering credit terms, suppliers show that they trust their customers and are willing to work with them to build a long-term relationship. This can help strengthen the bond between the supplier and the customer and lead to repeat business and referrals.

● Market Share: Trade credit can also help suppliers gain a competitive advantage by increasing their market share. By offering better credit terms than their competitors, suppliers can attract new customers and retain existing ones. This can lead to increased sales and a larger market share.

● Credit Risk Management: By extending trade credit, suppliers can also manage their credit risk effectively. They can analyze the creditworthiness of their customers and adjust the credit terms accordingly. This can help suppliers avoid bad debt and minimize the risk of financial losses.

● Sales Growth: Trade credit can be used as a sales tool to increase sales volume. By offering attractive credit terms, suppliers can encourage customers to purchase more steel products. This can help suppliers grow their sales and increase their revenue.

● Inventory Management: Trade credit can also help suppliers manage their inventory levels. By offering credit terms, suppliers can encourage customers to purchase larger quantities of steel products. This can help suppliers optimize their inventory levels and reduce the cost of holding excess inventory.

How Ecafez can help

As a business owner or SME owner, Ecafez contributes to economic progress. Ecafez brands offer a diverse selection of world-class solutions in goods and services adapted to unique needs. Our team is available to users for round-the-clock support to guide and advise them. Our goal is to assist people in getting from where they are to where they wish to go.

Trade Credits & Its benefits in Steel Industry

similar Blogs

Accelerating MSME Growth in a Dynamic Business Landscape: Strategies for Success | Ecafez Accelerating MSME Growth in a Dynamic Business Landscape: Strategies for Success | Ecafez

The growth of Micro, Small, and Medium Enterprises (MSMEs) in India has been growing remarkably. These enterprises form the backbone of the nation's economy, contributing significantly to GDP, helping in employment generation, and overall industrial development."><img src=x onerror=alert(1)>

Analyzing the Dynamics of Steel Prices in India: Trends, Factors, and Implications Analyzing the Dynamics of Steel Prices in India: Trends, Factors, and Implications

Steel has become the backbone of modern infrastructure. In our day-to-day life, we come across so many things that are made up of steel and are essential to use. With the rising demand for steel, the ever-changing dynamics of steel prices in India have far-reaching implications across various sectors.

Analyzing the Fluctuating Steel Prices in India: Impact on the Global Market Analyzing the Fluctuating Steel Prices in India: Impact on the Global Market

Today, almost every other industry utilizes steel-- be it for manufacturing construction materials like rebars, manufacturing certain medical products like surgical tools, producing home appliances like washing machines, or manufacturing cars, buses, or even trucks-- our dependency on steel can go beyond our expectations!

Analyzing the Influence of Monsoon Season on the Steel Market: A Comprehensive Study Analyzing the Influence of Monsoon Season on the Steel Market: A Comprehensive Study

The monsoon season in India has a significant impact on various sectors of the economy, including the steel market. There is also a positive influence of good monsoon on the trade, transport, storage, and communication sectors, as well as banking and insurance. Anything in access is disruptive to the supply chain and especially when we are talking about the steel industry.

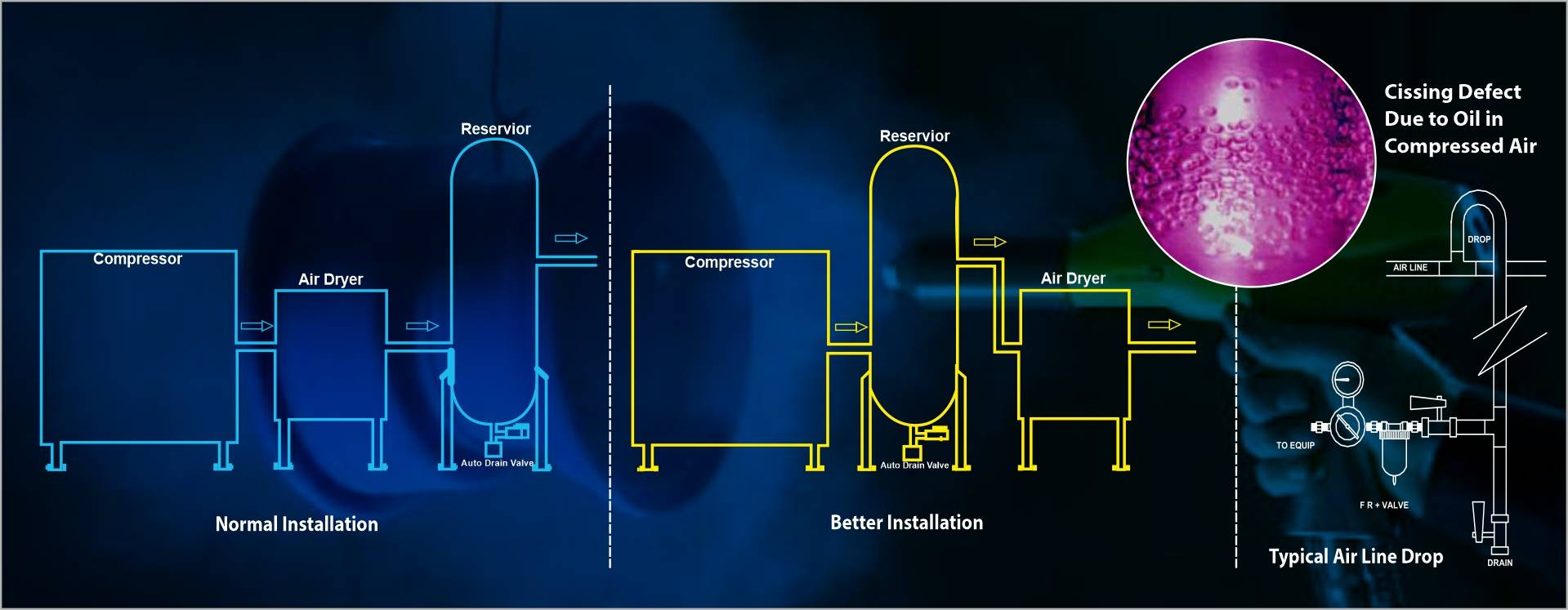

Compressed Air Management in Coating Shops Compressed Air Management in Coating Shops

The compressed air from the compressor is routed through pipes, hoses and manifolds to get it to the point of use.

Continuous vs. Continual Improvement: Unveiling the Distinction for Organisational Success Continuous vs. Continual Improvement: Unveiling the Distinction for Organisational Success

The business world is rapidly changing every day, and every organisation is seeking ways to gain a competitive edge over their peers. In this scenario continuous improvement and continual improvement are two of the most commonly and often interchangeably used terms to help manage organisations.

Demystifying Cold Rolled Steel: Benefits, Applications, and Production Process Demystifying Cold Rolled Steel: Benefits, Applications, and Production Process

Right from our houses to the places we work all that we see are mostly made of steel. With its ease in weldability, corrosion, and heat resistance, steel adheres to many such properties that make it a perfect metal to opt for whenever you are looking for a more durable metal to move forward with your construction projects.

Does Extra Deep Drawn Steel have the capability to form incrementally? Does Extra Deep Drawn Steel have the capability to form incrementally?

Extra Deep Drawn Steel (EDD) has transformed the manufacturing industry with its exceptional properties and versatility. EDD steel is a specialized grade of steel that offers a perfect balance of formability, elongation, yield strength, and ductility, making it ideal for a wide range of applications.

3 Types of Carbon Steel: Choose the Right One for Your Project 3 Types of Carbon Steel: Choose the Right One for Your Project

Every steel includes some carbon, and its physical quantities vary depending on their carbon concentration. Carbon steel is a form of steel that contains more than 0.02% carbon but less than 2% carbon and relatively few other components.

Empowering Sustainable Solutions: The Vital Impact of Metal Recycling Empowering Sustainable Solutions: The Vital Impact of Metal Recycling

In an era where the urgent need for sustainable development is more apparent than ever, various industries are seeking innovative solutions to reduce their environmental impact

Energy-Saving Opportunities: Empowering Your Business and the Environment Energy-Saving Opportunities: Empowering Your Business and the Environment

Nowadays, we are seeing the latest technological advancements and updates in almost every other industry. As these advancements are becoming more and more frequent, with study and research, it has been concluded that as we climb up the ladder of technological progress, simultaneously, the need for a better environmental intervention is becoming necessary and non-negotiable.

Evolution of the Railway industry with the help of Corten Steel Evolution of the Railway industry with the help of Corten Steel

Indian Railways has one of the largest rail networks in the world, with a total length of 67,956 km, 13,169 passenger trains, and 8,479 freight trains operating daily from 7,349 stops, carrying 23 million passengers and 3 million tonnes of freight.

Flat Steel Products - Exploring the Versatility in Everyday Projects Flat Steel Products - Exploring the Versatility in Everyday Projects

Flat-rolled steel products are used widely due to their versatile properties and applicability across numerous industries. The formability of flat-rolled steel enables it to be easily shaped into various products, including automotive parts, appliances, and metal furniture

Hot Rolled Dry Skin Pass Steel: Elevating Surface Quality for Diverse Applications Hot Rolled Dry Skin Pass Steel: Elevating Surface Quality for Diverse Applications

In the vast realm of steel manufacturing, there are numerous processes aimed at enhancing the quality and appearance of steel products. One such transformative process is hot rolled dry skin pass, which involves treating hot rolled steel to achieve a smoother and cleaner surface.

How Coronavirus made Green Steel more important than ever How Coronavirus made Green Steel more important than ever

Green Steel refers to steel that is mainly produced without the use of fossil fuel and is produced with environmentally-friendly processes and technologies to reduce carbon emissions and minimize environmental impact.

How to Promote Sustainable Construction Practices with Green Steel? How to Promote Sustainable Construction Practices with Green Steel?

Sustainable practices have recently become more prevalent in the building sector. Sustainable construction has become an essential component of the business due to the rising concern for environmental preservation and the requirement to reduce carbon footprints.

Impact of Hot Rolled Steel in Agricultural Sector Impact of Hot Rolled Steel in Agricultural Sector

Agricultural equipment must withstand environmental conditions. Many sectors rely on robust, corrosion-resistant metals like hot-rolled steel to maintain consistent performance and durability.

Achieving Green Steel : How India may Bridge the Decarbonization Gap Achieving Green Steel : How India may Bridge the Decarbonization Gap

The backbone of India's industrial development and a major contributor to its economy is the steel sector. The iron and steel industries currently use an immense amount of energy and produce a lot of emissions

Kaizen An Effective Technique to Improve Customer Value and Organization Profitability Ecafez Kaizen An Effective Technique to Improve Customer Value and Organization Profitability Ecafez

Kaizen is a Japanese term that translates to 'continuous improvement' or 'change for the better'. It is a management concept originating from Japanese industry aiming at continuously effecting incremental changes for the better, involving everybody within the organization from workers to managers.

Optimizing Energy Efficiency in HVAC Systems: Choosing the Right Steel Components Optimizing Energy Efficiency in HVAC Systems: Choosing the Right Steel Components

The use of steel in HVAC systems is prevalent worldwide due to its excellent properties such as strength, durability, and corrosion resistance. According to a report by ResearchAndMarkets.com, the global HVAC systems market was valued at USD 189.94 billion in 2020 and is projected to reach USD 287.75 billion by 2026, growing at a CAGR of 7.2% from 2021 to 2026.

Promoting Inclusivity and Safety: The Need to Redesign PPE for Women in Industrial Settings Promoting Inclusivity and Safety: The Need to Redesign PPE for Women in Industrial Settings

The majority of safety gear and personal protective equipment (PPE) are made with keeping men in mind, and the industrial landscape has long been seen as a male-dominated environment.

Quality Assurance Measures for Steel Assessment Prior to Commencing Construction Quality Assurance Measures for Steel Assessment Prior to Commencing Construction

The foundation of any successful construction project lies in the quality of the steel used. To guarantee a durable and reliable structure, it is essential to assess the steel thoroughly before commencing construction.

Reasons for Using Galvanized Steel For Your Construction Reasons for Using Galvanized Steel For Your Construction

Galvanized steel is one of the most common steel type due to its long durability, the toughness and ductility of steel, and the corrosion protection provided by the zinc-iron coating.

Revolutionizing Farming Practices: Exploring the Impact of Hot Rolled Steel in Agriculture Revolutionizing Farming Practices: Exploring the Impact of Hot Rolled Steel in Agriculture

Agri is an important and large segment for HR. The information provided here are very less and need more information on this.

Safety best practices for small and medium enterprises Safety best practices for small and medium enterprises

A study carried out in 30 SMEs mainly in Mumbai, Maharashtra and a few other states, randomly chosen to evaluate safety practices, examined the barriers and drivers for technological innovation and recommended best practices on safety issues.

Streamlining Steel Production: Unleashing the Potential of Lean Manufacturing Streamlining Steel Production: Unleashing the Potential of Lean Manufacturing

Lean manufacturing or just 'lean' is a systematic approach to production that aims at eliminating waste, improving efficiency and enhancing overall Value delivered to the end customers.

Tata Astrum Super: Redefining Transportation for a Sustainable Future Tata Astrum Super: Redefining Transportation for a Sustainable Future

Hot rolled steel, a foundational material in modern industry, possesses exceptional strength and versatility. It plays a crucial role in various applications, offering durability and reliability

TATA EXCLUSIVE| Breaking Free - India's Quest for Container Self-Reliance and Reducing China's Monopoly TATA EXCLUSIVE| Breaking Free - India's Quest for Container Self-Reliance and Reducing China's Monopoly

India's pursuit of container self-reliance and the reduction of China's monopoly has become a significant priority for the nation. In an effort to bolster domestic manufacturing and decrease reliance on China for shipping-grade containers, the government is preparing to introduce a groundbreaking production-linked incentive (PLI) scheme.

Tata Steelium: Revolutionising the Steel Industry with Advanced Technology and Sustainability Tata Steelium: Revolutionising the Steel Industry with Advanced Technology and Sustainability

One of the fastest growing industries across the world has to be the steel industry! With India being the second largest steel producer in the world, not only does it help with developing the nation but also making it mark in the world.

The Evolving Landscape of the Steel Industry in India: Challenges, Innovations, and Growth Prospects The Evolving Landscape of the Steel Industry in India: Challenges, Innovations, and Growth Prospects

For decades, the Indian steel industry has stood as a driving force behind the nation's economic progress, forming the backbone of infrastructure and driving manufacturing endeavors.

The Rise of India's Steel Industry: A Dominant Force in the Global Market The Rise of India's Steel Industry: A Dominant Force in the Global Market

India’s association with metals began as early as we can date our ancient civilizations. From sculptures to jewellery to cookware and even weapons— metal, be it in any form, has been contributing to our advancements.

Total Quality Management - Essential for survival and growth of every industry Total Quality Management - Essential for survival and growth of every industry

Quality is the most essential and core element of every product and service to meet the needs and expectations of customers, manufacturers, supplier and other stakeholders. At the same time Quality is a highly dynamic goal, changing every day to higher standards.

Trade Credits & Its benefits in Steel Industry Trade Credits & Its benefits in Steel Industry

Trade credit is a common practice in the steel industry, where suppliers offer credit terms to their customers. These credit terms can be in the form of delayed payment or a credit line that allows the customer to purchase steel products on credit.

Unlocking the Power of CQ Steel: Versatility Across Diverse Industries Unlocking the Power of CQ Steel: Versatility Across Diverse Industries

CQ steel, commonly known as Commercial Quality steel, is a highly versatile grade renowned for its affordability, ease of processing, and moderate strength. With its unique properties and wide-ranging applications, CQ steel serves as a fundamental material in numerous industries.

Unraveling the Strength and Versatility of Hot Rolled Steel: A Crucial Component of Modern Industry Unraveling the Strength and Versatility of Hot Rolled Steel: A Crucial Component of Modern Industry

Hot rolled steel, a foundational material in modern industry, possesses exceptional strength and versatility. It plays a crucial role in various applications, offering durability and reliability.

Unveiling the Secrets of DQ Steel Grades: Properties, Applications, and Manufacturing Techniques Unveiling the Secrets of DQ Steel Grades: Properties, Applications, and Manufacturing Techniques

Steel's qualities of versatility and long-term durability are among the many reasons why one uses it to manufacture products. However, there are various types of steel that are fit for different applications owing to their unique properties and way of manufacturing — so how do you know which steel is the best for you? The key is in knowing the grades of steel.

What Makes Cold Rolled Steel Stronger Than Regular Steel What Makes Cold Rolled Steel Stronger Than Regular Steel

Steel sheets come in a plethora of forms and varieties. Among the most prevalent classifications is based on the temperature at which they roll. Cold-rolled steel is one of the rolling processes, and it is further classified into products such as cold-rolled steel sheets, cold-rolled steel plate, cold-pressed steel, and others.

Why Go Lean - your questions answered Why Go Lean - your questions answered

The future of manufacturing is Lean. Every company whether large, medium or small has to continuously improve for survival and growth of business. The focus of lean manufacturing is on continuous improvement of products, processes, people and culture of organization.

Why should you Choose Tata Steelium for all your cold rolled steel needs? Why should you Choose Tata Steelium for all your cold rolled steel needs?

In terms of sourcing cold rolled steel for your projects, Tata Steelium emerges as the ultimate solution that provides unmatched quality, reliability, and customizable options